Pluxee Annual Report 2024 2024

-

Cover

This copy of the annual financial reporting of Pluxee N.V. for the year ended August 31, 2024 is not presented in the ESEF-format as specified in the Regulatory Technical Standards on ESEF (Delegated Regulation (EU) 2019/815). The ESEF single reporting package is available at: https://www.afm.nl/en/sector/registers.

-

Introduction

“Pluxee has immense scope for growth. The ever-evolving employee engagement market has tremendous potential.”

Publishing our first annual report brings a sense of accomplishment. It marks the beginning of a new endeavor — a moment made possible by the people who laid the groundwork for Pluxee’s remarkable transformation. I especially want to thank our 5,400+ employees around the world, who have worked tirelessly to make this ambitious spin-off project a success. Every single one of them has met this challenge with enthusiasm, rallying around the shared goal of strengthening our position as a global leader in Employee Benefits and Engagement.

It has been an honor for me personally to join Pluxee as Executive Chair of the Board of Directors. My goal was to create a Board comprised of members whose experience spans technology start-ups and major publicly listed companies, individuals with strong expertise in digital technology, data management, cybersecurity, payment, human resources and other areas. I am grateful to all our Board members who bring their enthusiasm to Pluxee because they see its potential. And lastly, I want to recognize what a vote of confidence—and source of stability—it is to have the support of Bellon S.A. for this new chapter at Pluxee. Together, we will oversee the Group as it executes its strategy.

Pluxee has immense scope for growth. Attracting, retaining, and engaging employees is a significant challenge for companies of every size, in every geography, and in every sector. The ever-evolving employee engagement market has tremendous potential.

Meal and Food benefits are where Pluxee got its start, and we’ve remained at the forefront of changing workplace practices for years. Today, through the broad range of our offering, we want to be our clients’ partner for happy, healthy employees both at work and in their every day lives.

To navigate the next phase, Pluxee aims to drive profitable growth by reinforcing our leadership in Meal and Food benefits and augmenting our offer of Employee Benefit and Engagement solutions in targeted markets.

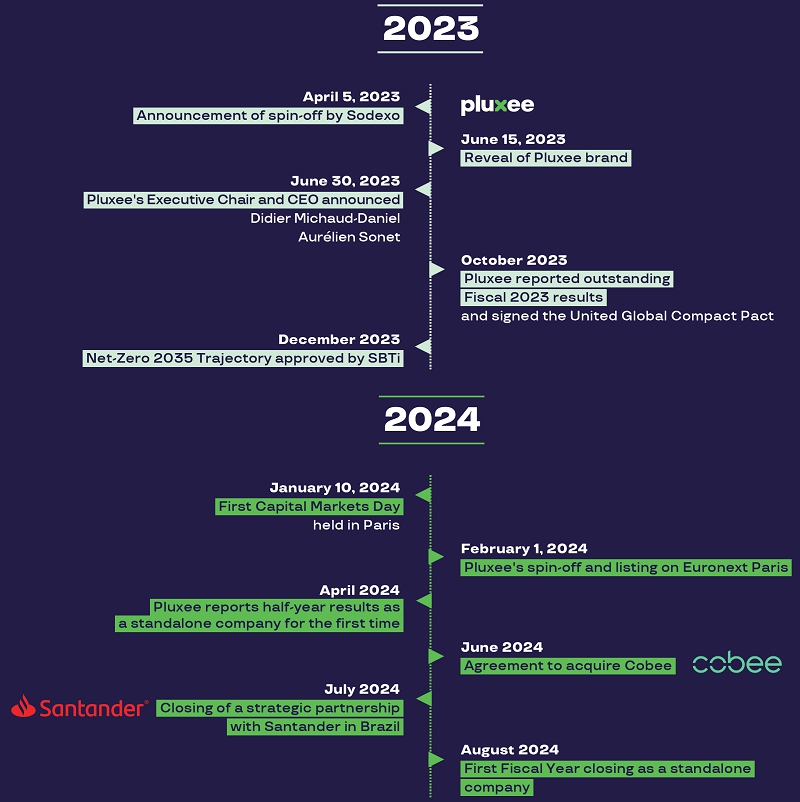

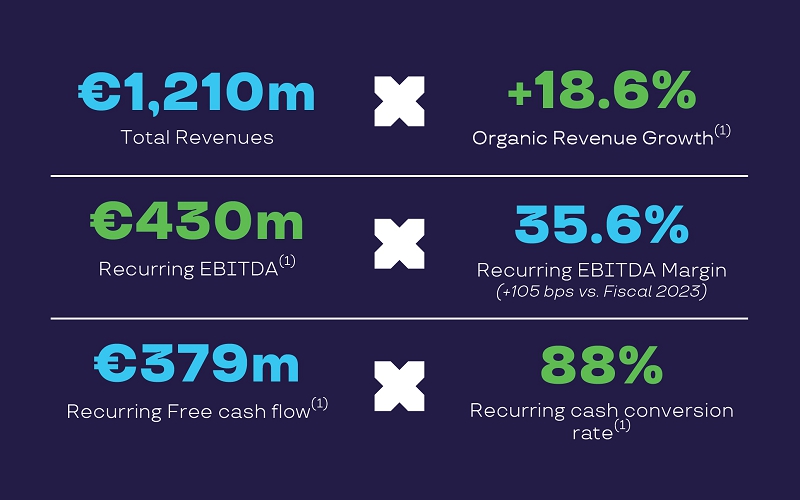

In Fiscal 2024 Pluxee went from success to success, starting with a flawless spin-off and listing on Euronext Paris on February 1. The Group has performed remarkably well, delivering Organic revenue growth of +18.6% up to 1.2 billion euros, and Recurring EBITDA of 430 million euros.

These excellent results demonstrate the soundness of our position as a pure player in Employee Benefits and Engagement. We have proven that we are up to the challenge and are in a strong position to accomplish our goals, continuing to create value for all of Pluxee’s stakeholders. I am delighted to support Pluxee as it delivers on its ambition over the coming year, bringing to life an enriching experience for employees.

1. Pluxee’s spin-off was a major milestone of 2024. What have you taken away from this exciting journey? It has been an exceptional year in every respect. We pulled off a challenging transformation of Pluxee and positioned it at the forefront of the Employee Benefit and Engagement market. We introduced our new brand, which embodies our positioning as a pure player in Employee Benefits and Engagement. We adopted an ambitious strategic plan, finalized our spin-off, successfully listed on the Euronext Paris stock market, and concluded our first M&A deal with the acquisition of Cobee in Spain. These achievements are driven by each of our employees around the world, and I want to highlight their efforts and thank them for all their hard work.

“We all share a common goal: delivering value to our clients, their employees, and our merchant partners, and ensuring their satisfaction.”

• first, we have the long-term support of Bellon S.A., and that’s a significant advantage as we implement our strategic plan; • second, we’ve strengthened our leadership team by appointing highly experienced, international executives to key positions and geographies; • lastly, we accomplished this transformation in a very short period of time, proving our agility and capacity to seize opportunities in a dynamic market. With these solid foundations, we’re well positioned and more determined than ever to begin the next chapter in Pluxee’s history.

2. What do you consider to be some of your most significant achievements in Pluxee’s first months as a standalone company? Pluxee has outperformed all the financial objectives it set for Fiscal 2024. Strong +18.6% Organic revenue growth, driving a significant increase in profitability, with Recurring EBITDA margin of 35.6% up +105 bps compared to Fiscal 2023, at current rates.

These results are partly due to very strong business momentum, with double-digit growth in business volume issued (BVI) in Employee Benefits. This solid performance reflects our ability to identify our clients’ needs and offer them new solutions that help improve the daily lives of their employees.

One of our many achievements is the multi-year agreement we’ve signed with Romania’s Ministry of Education, which is rewarding over 300,000 teachers with an attractive benefits program.

In France, we’re proud to have provided the Pluxee Restaurant Card to the security forces deployed for the Paris 2024 Olympic and Paralympic Games.

In Fiscal 2024, we also ramped up our growth in Brazil—one of our key markets—by completing our strategic partnership with Santander. Pluxee can now leverage this global bank’s 4,000 sales managers—2,500 of whom specialize in small and medium-sized enterprises (SMEs)—and access over 1.4 million Santander clients across Brazil.

These results demonstrate our commitment to executing our strategic plan. Everyone is on board, from the Executive Committee to our teams around the world, and we’re on track to meet our Fiscal 2026 objectives.

Our global operations in 29 countries offer us a nuanced understanding of the trends shaping the world of work, along with the ability to act on them. The Covid crisis disrupted people’s relationship with their work in a fundamental way. Employees now expect their employers to do even more to protect and increase their purchasing power and improve their well-being. Our solutions help companies meet these expectations and are a valuable asset for them. All companies face the same challenge—attracting and retaining employees.

All of which gives us a great opportunity to gain a larger share of a market already worth more than 1,000 billion euros.

Our strategy is based on two complementary pillars: First, we are strengthening our leadership in Meal and Food benefits. There remains significant untapped potential in this market, where only 10% of SMEs offer employee benefit packages. This is a key strategic priority for Pluxee: we aim to have new SME client accounts for more than 30% of our new business volume growth by the end of Fiscal 2026.

Second, we’re adding new benefits to our offer to meet the changing needs of employees. Our multi-benefit range, covering meals, food, gifts, and mental and physical well-being, is currently available in 16 countries and will expand to more than 20 by Fiscal 2026.

This strategy is supported by ongoing investments in our products, technology, data, and digital marketing. We are rapidly advancing in the use of artificial intelligence to provide more customized services and more efficient processes.

Originally, we catered to the desire of companies to offer their employees a nourishing meal and pleasant lunch break. Since then, lunch breaks have become a must in many countries around the world, and employees expect more than just meal vouchers.

Pluxee has reinvented itself to better address evolving expectations at work and beyond. We leverage our 45+ years of experience along with the agility and energy injected by the spin-off, and our new positioning as a pure player in Employee Benefits and Engagement. We operate in 29 countries, are market leaders in at least one vertical in 17 of them, and continuously enrich our extensive range of employee benefits, with 250 products and services.

With our laser focus on Employee Benefits and Engagement, we now also have more clout. We all share a common goal: delivering value to our clients, their employees and our merchant partners, and ensuring their satisfaction. They are all part of an interconnected ecosystem—with Pluxee as its driving force—that represents a business volume of 24 billion euros.

The essence of our business is to help everyone enjoy more of what really matters in their lives. This human dimension is paramount. That’s the spirit that drives Pluxee. Each one of us is motivated by the desire to enhance the employee experience.

To help shape Pluxee’s motivating culture, and define how we work together, we’ve created Life@Pluxee. With input from 1,200 employees, we’ve defined four core principles. Our aim is to:

But we won’t stop there. We’re using cutting edge technology from our partner, The Happiness Index, to measure our employees’ well-being and enthusiasm so we can closely follow their experience. That also means we’ll be able to adapt our HR policies and management style to better meet their needs.

At Pluxee, we believe progress comes from people working together. Today, we are a trusted partner for our clients, our affiliated merchants, and the people who use our services. These relationships are built on our commitment to making a positive impact on society and protecting the environment.

Every year, we support local economic development by generating 6.2 billion euros in business volume for SME merchants. We plan to increase it to 8 billion euros by Fiscal 2026. As a digital company, we also back numerous projects designed to help women enter digital professions, such as “Women in Tech”. Our Social Hub program in Brazil is enabling women running SMEs to develop the digital and management skills they need to grow their businesses.

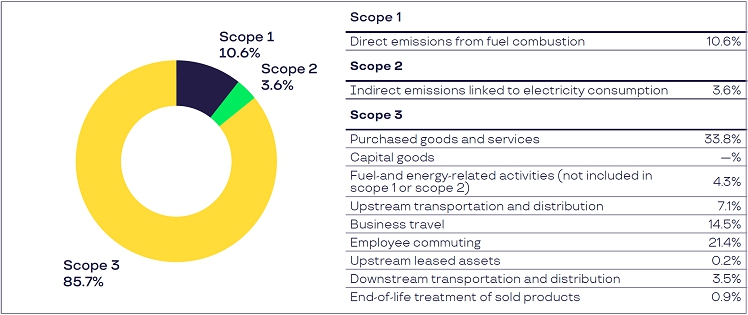

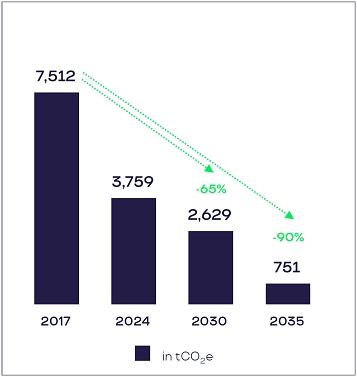

And we are the first company in our sector to have adopted a Net-Zero trajectory to cut our carbon footprint by 2035. We’re working on every aspect of our operations and value chain to curb emissions.

“The human dimension is paramount. Each one of us is driven by the desire to enhance the employee experience.”

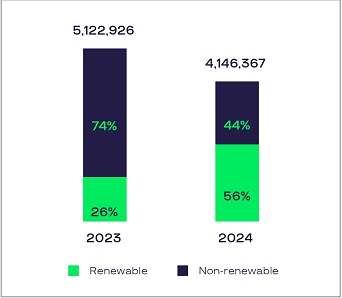

To start, we have optimized space use and electricity consumption and have transitioned to renewable electricity sources across our locations. And, when it comes to clients, we are developing and prioritizing virtual solutions, and increasing the use of alternative materials with a lower carbon footprint.

Pluxee delivered a solid performance in Fiscal 2024, and I’m excited about what the future holds for us. We have a clear goal: to support them as they navigate changes in the working world. We do this by meeting employee expectations on how to improve their purchasing power and well-being, and by making sure our clients, partners and consumers have what they need to make more responsible choices every day.

In a record time of nine months, Pluxee accomplished a successful spin-off while delivering a historically-high financial performance.

We shape the world of employee benefits and engagement by bringing to life a personalized and sustainable employee experience at work and beyond.

For over four decades, we have been contributing to making work not just a place to be, but a place to belong.

Driven by people and enabled by technology, we act as the beating heart of a rich ecosystem of stakeholders.

We are a trusted partner to private and public companies, committed to nurturing vibrant workplaces that attract, grow and retain talent.

We are a smart companion to employees – our clients’ and our own. We continuously evolve our digital and personalized solutions to transcend well-being, helping to build meaningful connections and communities.

We are a reliable ally to local businesses, working hand-in-hand to support their success and better serve their consumers.

Moving forward, our goal is to strengthen our positive impact on the communities of which we are a part. Whether it’s through our own continuous efforts or those of our partners, we are cultivating solidarity, diversity, inclusion and sustainability, in the pursuit of progress for all.

Pluxee delivers more than just benefits; it’s about paving the path toward a more joyful and meaningful life.

At Pluxee, we focus on delivering value to each of our stakeholders. We are constantly evolving our range of solutions to meet the changing needs of our entire ecosystem.

Source: Group information for Fiscal 2024 Total Revenues in million euros and percentage of Total Revenues.

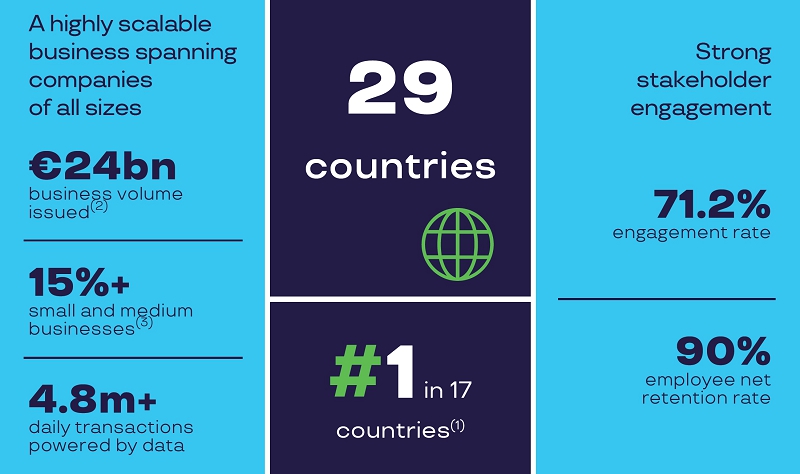

(1) Countries where Pluxee is market leader in at least one vertical. (2) Business volume issued (BVI) corresponds to the cumulative value of benefits issued by the Group on behalf of clients in the form of paper vouchers, cards and digitally delivered services, and in respect of which commissions are charged to clients. (3) Percentage of total BVI accounted for by small and medium-sized businesses. Pluxee’s results as a standalone listed company underscore the progress made toward delivering the Group’s strategic growth plan and financial objectives. Strong business momentum continued in Fiscal 2024, with top-line growth outperforming expectations, and strong improvement in Recurring EBITDA margin.

Source: Group information as of Fiscal 2024. For more information, see section 3 Business Performance.

(1) Financial indicator not defined in IFRS, see section 3.5 Alternative performance measure (APM) definitions At Pluxee, sustainability priorities are embedded in our Strategic Growth plan. As a trusted partner to our stakeholders, we are committed to having a positive impact by driving business in local communities, supporting employee well-being at work, and preserving the planet. Together, we are building a world where sustainability and innovation go hand-in-hand, enabling people to live more joyful and meaningful lives.

-

1.1 Introduction to Pluxee

1.1.1 A global leader in Employee Benefits & Engagement

The Pluxee Group is an Employee Benefit and Engagement solutions pure player with significant Public Benefit activities.

The Group is the second largest provider worldwide of Employee Benefit and Engagement solutions, and the largest player in 17 countries in at least one benefit category locally, according to available public and market sources.

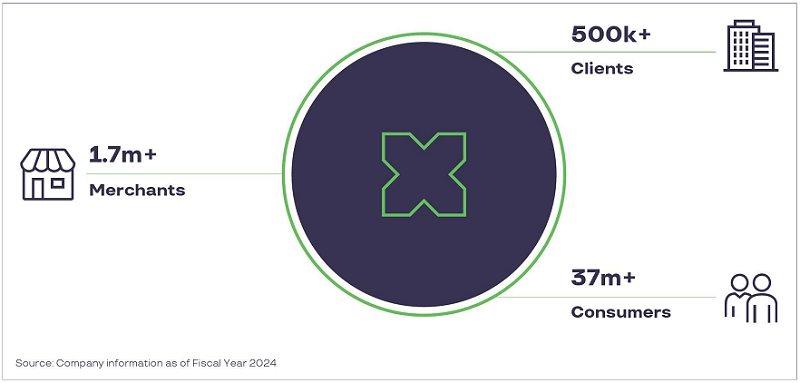

As of August 31, 2024, Pluxee delivers over 250 programs to clients in 291 countries. The Group sells a comprehensive suite of benefits to more than half a million clients across the globe, comprised of public and private companies spanning all sizes and industries, as well as public institutions.

The employee benefits provided by the Group help clients augment their employees’ compensation package in ways that are particularly engaging for employees and efficient for clients. Operating in a B2B2C model, Pluxee reaches 37 million+ consumers through its client base. These consumers have access to Pluxee’s proprietary merchant network comprised of 1.7 million+ partners and 600 delivery and e-commerce platforms (as of August 31, 2024).

Reflecting Pluxee’s mission to “bring to life a personalized and sustainable employee experience at work and beyond”, the Group provides a wide range of benefits through its rich network of merchant partners who offer meal, food, gift, mental and physical well-being services, mobility services, culture, and many other lifestyle benefits.

Pluxee thus contributes to increased purchasing power, healthy lifestyles, work-life balance, and eco-responsibility, reflecting the diverse needs of companies and their employees. The Group also provides reward and recognition programs to encourage behaviors in line with company goals and to recognize performance. All these solutions act as powerful levers to help clients attract, grow, and retain talent.

Driven by people and enabled by technology, Pluxee has developed an advanced and rapidly evolving digital ecosystem integrating three groups of stakeholders: clients, consumers, and merchants. This highly interconnected ecosystem is at the heart of Pluxee’s B2B2C business model.

This ecosystem provides a compelling consumer experience, seamlessly supporting daily, recurrent benefit usage such as meal, food and mobility benefits or more occasional interactions (mental and physical well-being, leisure, etc.). Consumers use pre-paid benefit cards, often fully virtualized, to make purchases at affiliated merchants’ points of sale, both physical and online. With 92% of its total business volume issued (BVI) digitalized on average over Fiscal 2024, Pluxee manages more than 4.8 million transactions daily.

Pluxee also provides digital interfaces and solutions to its clients to optimize their experience at each stage of their journey. These tech-enabled tools provide a smooth experience when onboarding new clients, interacting with existing ones, or assisting them when they consider purchasing new benefits. The Group has developed optimized client journeys for small and medium enterprises to facilitate their access to benefit products. Its digital solutions also enable merchants to go fully digital from affiliation to virtual payment and reimbursement tracking.

Pluxee is a reliable ally to local businesses, generating positive returns for merchants who benefit from access to recurring purchases from consumers, digital interfaces for their daily operations, and value-added services, all of which positively impact their top-line and efficiency.

Additionally, Pluxee leverages its know-how to help local authorities and public institutions reach people in need, facilitating the distribution of social benefits. The Group’s services help public authorities promote the welfare of vulnerable citizens by providing access to food, transport, and other social aid services. The Group also provides efficient means for public authorities to channel specific purpose funds to different groups of citizens to encourage specific spending behaviors (eco-responsible, buying local, etc.). Pluxee thereby enhances the effective distribution of public programs, leading to positive outcomes for a broad range of stakeholders.

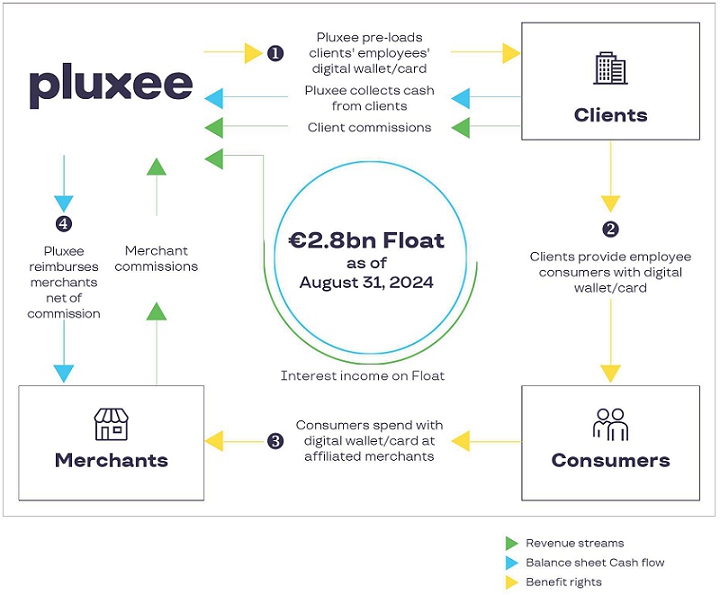

The Group’s business model is based on corporate clients, who load funds representing the amount of benefits that their employees will spend, onto a Pluxee account. Funds from this account are paid out to merchants progressively as employees use their benefits in the merchant network. This pre-paid B2B2C model provides revenue sources from clients, merchants, and Float investment. It leads to a platform that initially requires volumes sufficient to amortize fixed costs, and eventually becomes scalable with growth (for more on Pluxee’s cash-generative business model, see section 1.3).

-

1.2 The Employee Benefit & Engagement Market

The Employee Benefit and Engagement market presents a very attractive growth opportunity, fueled by three powerful structural elements:

• Robust, sustained market growth underpinned by macroeconomic tailwinds in key countries, and the continuous growth of the employee population, particularly in developing markets; • The combination of compelling megatrends and supportive regulation in key markets, including an upward trend in the value of authorized tax exemption thresholds. These macroeconomic expectations and global trends lead to an estimated annual growth rate for the Meal and Food Benefit direct captured market in a range of 7 to 9% for Fiscal 2024 to Fiscal 2026.

Specific dynamics within job markets in Pluxee’s countries, and evolving consumer trends also underscore the growth case for the services Pluxee offers:

• the increase in demand for enhanced employee engagement solutions driven by competition for talent among companies; • the growing adoption of employee benefits, driven by increasing penetration of the small and medium-sized enterprise segment; • the positive impact of the shift to more work-from-home, with an evolution toward digital meal benefits or hybrid offers. 1.2.1 A large and underpenetrated market

(1) Total addressable Employee Benefit and Engagement market: Aggregate BV of all companies that are eligible to provide employee benefits, incl. those that do not offer these services to their employees. The size of the global addressable Employee Benefit & Engagement market in Fiscal 2024 was estimated to be more than 1,000 billion euros in business volume. This estimate takes into account the aggregate potential business volume of all companies that are eligible to grant employee benefits (regardless of whether or not they actually offer such benefits to their employees), calculated on the basis of:

• the estimated maximum allowance that could be granted to an employee as a benefit in a given country; • multiplied by the total number of employees that are eligible to receive employee benefits in that country. The markets for both employee benefits and engagement are estimated to be largely underpenetrated and to be growing dynamically and continuously.

Notably in Meal and Food, accounting for 20 to 30% of the total Employee Benefit & Engagement business, the market is estimated to grow on a 7 to 9% CAGR over Fiscal 2024 to Fiscal 2026, with a penetration rate that stands at approximately 25% of the total addressable market. Within Meal and Food, the small and medium-sized enterprise segment has a significantly lower penetration rate than larger companies, and provides a particularly compelling growth opportunity.

-

1.3 Pluxee’s Cash-Generative and Scalable Business Model

• 500,000+ clients, comprised essentially of large, small and medium-sized enterprises, whose human resources departments contract benefit products and services on behalf of their employees; • 37 million+ consumers, comprised of the employees who are granted Pluxee-branded benefits by their employers; • 1.7 million+ merchants sell their products which are redeemed through Pluxee’s various benefit products and solutions. Pluxee operates a prepaid business, collecting cash from clients when they order the Group’s solutions, and then loading the cards and digital wallets of the clients’ employees, the end-consumers. The amount loaded onto cards and digital devices corresponds to the Group’s business volume issued (BVI). The end-users, or consumers, then spend their benefits within the merchant network. Finally, the Group reimburses the merchants (business volume reimbursed, or BVR). This model generates three main sources of revenue:

The Float is made up of the cash collected from clients before employee benefits are issued. It remains on Pluxee’s balance sheet until these funds are reimbursed to the merchants where the end-consumers disbursed their benefits. At August 31, 2024, the Float stood at 2.8 billion euros.

Pluxee thus operates a highly scalable B2B2C business model: in which more business volume leads to revenue growth, which in turn positively impacts Pluxee’s profitability.

-

1.4 A Value Proposition for All Business Stakeholders

1.4.1 A customized value proposition

Pluxee offers a value proposition that fits the needs and requirements of each stakeholder in its B2B2C ecosystem.

Clients

Clients Merchants

Merchants Consumers

ConsumersPluxee is a tech-enabled partner, providing attractive solutions that can:

• Provide tax-effective, compliant, secure, and flexible benefit solutions for employees

• Increase employee engagement

• Ensure seamless onboarding and excellent customer support

Pluxee is a trusted business partner that can help drive:

• Predictable traffic with access to recurring consumers

• An incremental revenue stream

• Augmented digital presence and local visibility

Pluxee enhances the employee experience by:

• Augmenting purchasing power

• Providing a broad choice of merchant options

• Providing multiple consumption and payment possibilities as well as simplified expense processes

-

1.5 Pluxee’s Profitable Growth Strategy

Pluxee is delivering on the roadmap it published in January 2024 at its Capital Markets Day. The Group’s strategic plan aims to drive ongoing profitable growth by combining global scale and deep local roots to further address a large underpenetrated market with high growth potential. Pluxee’s competitive advantages enable the Group to accelerate the expansion of its Employee Benefit and Engagement products and solutions.

1.5.1 Key pillars and foundational enablers

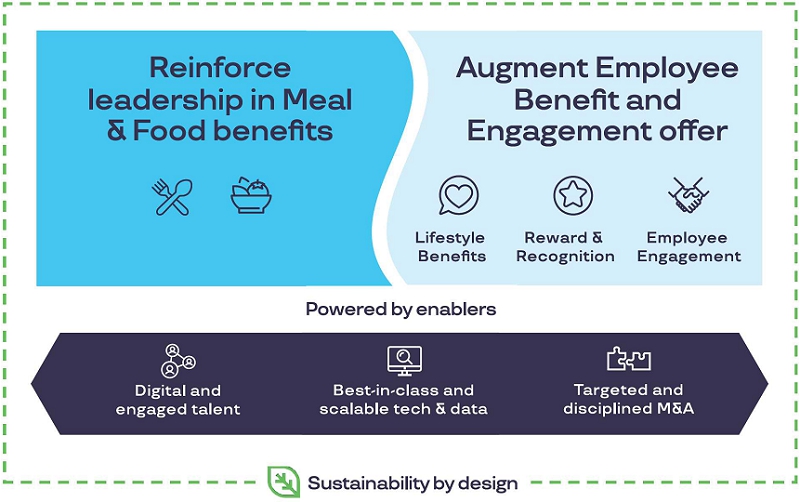

To consolidate and amplify its strong market position and to continue to drive profitable growth, Pluxee builds the expansion of its business on two key strategic pillars:

-

2.1 Corporate governance

This section of the Annual Report describes relevant elements of Pluxee’s corporate governance practices and provides the information required by the Dutch governmental Decree on Corporate Governance (Besluit inhoud bestuursverslag). This section also includes an explanation of how Pluxee applies the principles and best practices of the Dutch Corporate Governance Code (the “Code”), and the Dutch governmental Decree on article 10 of the Takeover Directive 2004/25 (Besluit artikel 10 overnamerichtlijn). The Code, which was updated on December 20, 2022, is publicly available on the website of the Dutch corporate governance code monitoring committee at www.mccg.nl.

Pluxee N.V. is a public limited liability company (naamloze vennootschap) governed by the laws of the Netherlands (in particular volume 2 of the Dutch civil code), the Code (on a comply or explain basis) and by its articles of association (the “Articles of Association”). The corporate seat of the Company is in Amsterdam, the Netherlands. Since its incorporation the Company has, and intends to continue to have, its place of effective management and sole registered location in France, moved during Fiscal 2024 at the Company’s address, 16 rue du Passeur de Boulogne, 92130 Issy-les-Moulineaux, France. The Articles of Association are publicly available on Pluxee N.V.’s website at www.pluxeegroup.com/board-of-directors.

Pluxee N.V. is subject to various legal provisions of the Dutch financial supervision act (Wet op het financieel toezicht) and of the Dutch financial reporting supervision act (Wet toezicht financiële verslaggeving). In addition, given that its shares trade on the regulated market of Euronext Paris, Pluxee N.V. is also subject to certain French laws and regulations.

2.1.1 Board of Directors

In accordance with its Articles of Association, Pluxee has a one-tier Board of Directors consisting of one Executive Director and nine Non-Executive Directors. The Board of Directors appointed the Executive Director as Executive Chair, as well as a Lead Director from among the independent Non-Executive Directors who serves as the chairperson (voorzitter) of the Board under Dutch law and within the meaning of the Code. The Board did not designate any vice chair. The Company adopted this governance structure on January 31, 2024 in the context of the Spin-off. Prior to that date the Company had a sole managing director.

• define, in cooperation with the Chief Executive Officer, the strategy and propose it to the Board for approval; • demonstrate the highest values of integrity and probity, giving very clear guidance and expectations regarding the Company’s culture and values, and dedicate sufficient time, energy and attention to ensure the diligent performance of its duties; • ensure, in cooperation with the Lead Director, that the Board work and functioning meets the defined standards of corporate governance; • assume all relevant responsibilities defined in the Board Rules; and • supervise and support the Chief Executive Officer. • the Non-Executive Directors have proper contact with the Executive Directors, and the General Meeting; • there is sufficient time for deliberation and decision-making by the Board and that the Directors receive all information that is necessary for the proper performance of their duties in a timely fashion; • the Board and the Committees have a balanced composition and function properly; • the functioning of individual Directors is reviewed at least annually; • the Directors follow their induction program, as well as their education or training program; • the Executive Directors perform activities in respect of corporate culture; • the Board is responsive to signs of misconduct or irregularities from the Company’s business; and • effective communication with the Company’s shareholders is assured. The Board is entrusted with the management of the Company subject to the restrictions contained in the Articles of Association and the law. This includes setting the Company’s policy and strategy. The Board may allocate its duties among the Directors by means of the Board Rules or otherwise in writing, with due observance of any limitations provided for by law or in the Articles of Association. The Board may determine in writing, in or pursuant to the Board Rules or otherwise pursuant to resolutions adopted by the Board, that one or more Directors can validly pass resolutions in respect of matters which fall under his/their duties. In performing their duties, Directors shall be guided by the interests of the Company and of the business connected with it.

The Executive Director, i.e., the Executive Chair, shall be entrusted primarily with the Company’s day-to-day operations and the Non-Executive Directors shall be entrusted primarily with the supervision of the performance of the duties of the Directors as specified in the Articles of Association and the Board Rules. The Non-Executive Directors also perform any duties allocated to them under, or pursuant to, the law and the Articles of Association.

The power to represent the Company vests in the Board of Directors and in the Executive Chair individually. The Board vested the salaried Chief Executive Officer, Aurélien Sonet, with representation powers pursuant to a power of attorney included in the Board Rules. The Chief Executive Officer is supervised by the Executive Chair, who in turn has limitations of authorities from the Board of Directors. These limitations and authorities are reflected in the Board Rules (see section 2.1.1.3).

Pursuant to the Articles of Association, the Board has established Board Rules concerning its organization, decision-making and other internal matters, with due observance of the Articles of Association. In performing their duties, the directors act in compliance with the Board Rules. The Board Rules are available on the Company’s website (www.pluxeegroup.com).

This section deals with the rules included in the Articles of Association and the Board Rules which support and apply to the above-mentioned governance structure of the Company.

The Articles of Association provide that the Board consists of one or more Executive Directors and one or more Non-Executive Directors. The Board shall be composed of individuals. The Board shall determine the number of Executive and Non-Executive Directors. Pursuant to the Board Rules, the Board shall be composed of at least eight Directors, consisting of one or two Executive Directors and, for the remainder, of Non-Executive Directors.

The Board may designate as Chief Executive Officer an Executive Director or any other employee or officer of the Company or Group Companies. The Board may also designate an Executive Director as Executive Chair. The Board shall further designate a Non-Executive Director as the Chair of the Board (voorzitter) for purposes of Dutch law. Such Non-Executive Director will carry the title “Chair”. However, if, and for as long as an Executive Chair is elected, the Chair of the Board (voorzitter) for purposes of Dutch law will carry the title of “Lead Director” instead of the title “Chair”. Certain duties and powers of the Chief Executive Officer, the Executive Chair and the Chair or Lead Director, as applicable, are set out in the Articles of Association and the Board Rules. If and for as long as (i) a Chief Executive Officer has been elected who is not an Executive Director and (ii) an Executive Chair has been elected, the Board’s tasks and responsibilities, as well as its decision-making authority, in respect of the matters that are delegated to the Chief Executive Officer pursuant to the Board Rules are instead delegated to, and shall be resolved upon by, the Executive Chair. The Executive Chair shall then authorize the Chief Executive Officer to implement and effect such matters under the supervision of the Executive Chair and ensure that the appropriate checks and balances are put in place to ensure appropriate oversight over the Chief Executive Officer’s exercise of its authorities set out in the Board Rules. The Board may designate one or more other Non-Executive Directors, other than the Chair or Lead Director, as applicable, as Vice-Chair.

The General Meeting shall appoint the Directors and may at any time suspend or dismiss any Director. Upon the appointment of a person as a Director, the General Meeting shall determine whether that person is appointed as Executive Director or as Non-Executive Director. In addition, the Board may at any time suspend an Executive Director. A resolution of the General Meeting to suspend or dismiss a Director can be passed by simple majority of votes cast representing more than one third of the issued share capital. A second meeting as referred to in article 2:120(3) BW cannot be convened. If a Director is suspended and the General Meeting does not resolve to dismiss him or her within three months from the date of such suspension, the suspension shall lapse.

Pursuant to the Board Rules, a person may be appointed as Executive Director or Non-Executive Director for a term up to the end of the annual General Meeting held in the fourth calendar year after the year of appointment, without limitation on the number of consecutive terms which an Executive Director or Non-Executive Director may serve. The Board drew up a rotation schedule for the Non-Executive Directors which may evolve over time, to achieve a staggered end to terms of office.

Resolutions of the Board shall be passed by a simple majority of votes cast, unless the Board Rules provide otherwise. Each Director entitled to vote may cast one vote in the decision-making of the Board. Where there is a tie in any vote of the Board, the Executive Chair has a casting vote, except for certain resolutions in which the Executive Chair shall not take part as set forth in the Board Rules (§6.15 referring to article 19.6 of the Articles of Association): the determination of the compensation of Executive Directors; and the instruction of an auditor to audit the annual accounts if the General Meeting has not granted such instruction. Otherwise, the relevant resolution shall be rejected.

Under the current set up, the Board shall meet as often as the Lead Director or the Executive Chair or any group of three directors jointly deem(s) necessary or appropriate and at least quarterly. A Board meeting may be convened by, or at the request of, the Lead Director, the Executive Chair or a group of three directors jointly by means of a written notice sent to all directors.

The Board’s meetings may take place virtually or at a physical location, and they are normally held at the Company’s offices in France, or another location in France, with the Executive Directors, the Chair or the Lead Director (as applicable), and a majority of directors physically attending. Meetings may only incidentally take place virtually. In compliance with the above principles, the form and location of the meetings will be determined by the Director convening the meeting as desirable given the circumstances.

Subject to the previous paragraph, Directors entitled to vote shall be given the opportunity to attend the meeting of the Board by telephone, videoconference or electronic communication, provided that (i) all participants can hear each other simultaneously, and (ii) Directors are not physically located in the Netherlands during such meeting unless exceptional circumstances require this. The Lead Director or the Executive Chair determines whether exceptional circumstances apply. Directors attending the meeting by telephone, videoconference or electronic communication are considered present at the meeting.

A Director can be represented by another Director entitled to vote holding a written proxy for the purpose of the deliberations and the decision-making of the Board.

The approval of the General Meeting is required for resolutions of the Board concerning a material change to the identity or the character of the Company or the business, including in any event:

• transferring the business or materially all of the business to a third party; • entering into or terminating a long-lasting alliance of the Company or of a Group Company either with another entity or company, or as a fully liable partner of a limited partnership or general partnership, if this alliance or termination is of significant importance for the Company; and • acquiring or disposing of an interest in the capital of a company by the Company or by a Group Company with a value of at least one third of the value of the assets, according to the balance sheet with explanatory notes or, if the Company prepares a consolidated balance sheet, according to the consolidated balance sheet with explanatory notes in the Company’s most recently adopted Annual Accounts; provided that the absence of approval of the General Meeting shall not affect the powers of representation of the Board or of the Directors.

Pursuant to the Articles of Association and the Board Rules, resolutions of the Board may, instead of at a meeting, be passed in writing, provided that all directors are familiar with the resolution to be passed and none of them, insofar as entitled to vote, objects to this decision-making process.

The Nomination and Remuneration Committee oversees the induction and training programs and provides advice on the annual training provided to Directors. This program covers strategy, governance and legal affairs, financial, social and sustainability reporting by the Company, specific aspects that are unique to the Company and its business, the Company’s culture and the responsibilities of Directors.

• the legal aspects of being a Director of a Dutch company listed on Euronext Paris as well as directors’ duties, corporate bodies functioning and disclosure requirements; • key drivers of the current Company strategy including the description of the competitive landscape and the business components; • preparation of the Group for the CSRD (ESG-related reporting), review of the Group’s activities relating to the Ethics Charter. In addition, each Non-Executive Director will be, as part of the Board annual evaluation, able to identify the aspects on which he or she requires training or education.

The Non-Executive Directors also discussed and received regular updates during Board meetings on commercial developments and the competitive landscape, notably with commercial and financial related KPIs.

On July 3, 2024 the Board of Directors adopted “Share ownership guidelines for members of the Board of Directors” whose purpose is to align the directors’ interests with the long-term interests of the shareholders of Pluxee: each member of the Board is expected to buy and own at least 500 ordinary shares by the end of his/her first year on the Board, and to hold them from that date until the end of the term of his/her office with Pluxee. Each Director shall comply with all legal trading obligations/prohibitions laid down in the “Insider Trading Prevention Policy” as approved by the Board.

-

2.2 Diversity, equity and inclusion

In accordance with the Code, the Company’s Board adopted a diversity, equity and inclusion policy made available on Pluxee’s website (the “DE&I Policy”). The DE&I Policy set specific, appropriate and ambitious targets in order to achieve a satisfactory balance in gender diversity and the other diversity and inclusion aspects of relevance to the Company.

• In respect of the Board’s composition, the gender diversity target for each of (i) the group of Executive Directors, and (ii) the group of Non-Executive Directors separately was set at a minimum of 40% female and a minimum of 40% male, provided that if the group of Executive Directors would be comprised of only one member, this gender diversity target applies to the Board as a whole. • The Board determined in the DE&I Policy the category of employees in managerial positions and the applicable objective: Pluxee shall continue to improve gender diversity in Fiscal 2024 with a focus on increasing the representation of women in Management Positions1 and reaching a ratio of at least 40% women by Fiscal 2026. In addition, end of Fiscal 2026 target on women ratio in Pluxee Leadership2 is 42%. -

2.3 Potential conflicts of interest

Pursuant to Dutch law and the Articles of Association, a Director shall not participate in the deliberations and decision-making of the Board on a matter in relation to which he or she has a direct or indirect personal interest which conflicts with the interests of the Company and of the business connected with it. If, as a result thereof, no resolution can be passed by the Board, the resolution may nevertheless be passed by the Board as if none of the Directors has a conflict of interests as described in the previous sentence. The previous sentence applies mutatis mutandis to the deliberations and decision-making of the Board in respect of related party transactions in which a Director is involved within the meaning of article 2:169(4) BW.

The Board Rules contain provisions on how to identify and address a conflict of interest of a Director, all in accordance with the Dutch civil code and the Code. A Director shall promptly report any actual or potential conflict of interests in a transaction that is of material significance to the Company and/or such Director to the other directors, providing all relevant information relating to such transaction, including the involvement of any Director’s spouse, registered partner or other life companion, foster child or any relative or in-law up to the second degree.

During Fiscal 2024, no transactions were entered into in which there were conflicts of interest with Directors that were of material significance to the Company, and best practice provisions 2.7.3 and 2.7.4 of the Code, which apply to the Company since its listing, have been complied with.

1 Management Positions include employees classified as managers or directors and Pluxee Leadership. 2 Pluxee Leadership includes the Chief Executive Officer, Pluxee’s Executive Committee, the direct reports of the Pluxee Executive Committee members (excluding executive assistants) and the members of Local Leadership. -

2.4 Shareholder rights

2.4.1 Rights attached to shares

The Ordinary Shares are ordinary shares in the issued and outstanding share capital of Pluxee with a nominal value of 0.01 euro each. In accordance with the Articles of Association, they rank pari passu with each other and holders of Ordinary Shares are entitled to dividends and other distributions declared and paid on them, if any. Each Ordinary Share carries dividend rights and entitles its holder to attend and to cast one vote at any General Meeting of the Company’s shareholders. There are no restrictions on voting rights attached to the Ordinary Shares.

Each holder of Ordinary Shares (a “Shareholder”) holding their Ordinary Shares in pure administrative form (nominatif pur) may at any time elect to participate in the loyalty voting structure by requesting that Pluxee register all or some of their Ordinary Shares in the loyalty register of Pluxee (the “Loyalty Share Register”). The registration of Ordinary Shares in the Loyalty Share Register blocks such shares from trading. If such number of Ordinary Shares has been registered in the Loyalty Share Register (and thus blocked from trading) for an uninterrupted period of four years in the name of the same Shareholder, such Shareholder becomes eligible to receive Special Voting Shares in the share capital of Pluxee with a nominal value of 0.01 euro each (“Special Voting Shares”) and the relevant Shareholder will be entitled to receive one Special Voting Share for each such Ordinary Share.

Pursuant to the loyalty voting structure foreseeing a grandfathering system described in the Prospectus, any holder for at least four years in their own name of fully paid-up Sodexo Shares in registered form was entitled to request within 20 trading days following the payment date, i.e. on February 5, 2024 that holding of the Ordinary Shares be deemed to have commenced on the first day of the period for which such Sodexo Grandfathering Ordinary Share was uninterruptedly held by such holder in their own name.

If, at any time, such Ordinary Shares are de-registered from the Loyalty Share Register for whatever reason, the relevant Shareholder will lose their entitlement to hold a corresponding number of Special Voting Shares. Shareholders holding Special Voting Shares are entitled to exercise one vote for each Ordinary Share held and one vote for each Special Voting Share held.

Upon issue of Ordinary Shares or grant of rights to subscribe for Ordinary Shares, each Shareholder shall have a pre-emptive right in proportion to the aggregate nominal amount of their Ordinary Shares. Shareholders do not have pre-emptive rights in respect of the Ordinary Shares issued: (i) to employees of the Company or of a Group Company, (ii) against contribution other than in cash, and (iii) to a person exercising a previously acquired right to subscribe for Ordinary Shares. Pre-emptive rights may be restricted or excluded by a resolution of the General Meeting or another corporate body authorized by the General Meeting for this purpose for a specified period not exceeding five years.

There are no restrictions on the transferability of the Ordinary Shares in the Articles of Association or under Dutch law. However, the transfer of Ordinary Shares to persons located or resident in, or who are citizens of, or who have a registered address in jurisdictions other than the Netherlands, however, may be subject to specific regulations or restrictions according to their securities laws.

The Special Voting Shares are governed by the provisions included in the Articles of Association and the Loyalty Voting Plan. These documents govern the issuance, allocation, acquisition, sale, holding, repurchase and transfer of the Special Voting Shares and certain aspects of the transfer and the registration of the Ordinary Shares in the Loyalty Share Register. These documents provide in particular that:

• Shareholders holding Special Voting Shares are entitled to exercise one vote for each Ordinary Share held and one vote for each Special Voting Share held; • no entitlement to Ordinary Shares’ dividend distributions is attached to Special Voting Shares. However, pursuant to the Articles of Association, holders of Special Voting Shares will be entitled to a minimum dividend, which is allocated to a separate Special Voting Shares dividend reserve (see below). The Company has no intention to propose any distribution from the Special Voting Shares dividend reserve; and • a transfer of Special Voting Shares shall require the prior approval of the Board (see article 15 of the Articles of Association). After the adoption of the Company’s financial statements that show that such distribution is allowed, the profits shown in the Annual Accounts in respect of a financial year shall be appropriated as follows, and in the following order of priority: (i) the Board shall determine which part of the profits shall be added the Company’s reserves, (ii) out of the remaining profits, an amount equal to one percent (1%) of the aggregate nominal value of the issued and outstanding Special Voting Shares, determined at the end of the last day of the previous financial year, shall be added to the Company’s special dividend reserve, provided that such amount shall be reduced, but never below zero, by any amounts added to the special dividend reserve in respect of any interim distribution from profits of the same financial year, and (iii) subject to article 27 of the Articles of Association, the remaining profits shall be at the disposal of the general meeting of shareholders for distribution on the Ordinary Shares. The Board shall determine how a shortfall that is determined by the adoption of the Company’s financial statements shall be accounted for. A loss may be set off against the reserves to be maintained by law only to the extent permitted by applicable law. All reserves maintained by the Company shall be attached exclusively to the Ordinary Shares, except for the special dividend reserve and the special capital reserve maintained for the holders of Special Voting Shares pursuant to the Articles of Association. The special voting capital reserve shall be applied exclusively for facilitating an issue of Special Voting Shares. For this purpose, the Board may allocate any part of the balance of the Company’s share premium reserve to the special capital reserve and vice versa.

If the Company is dissolved or liquidated, the Company’s assets shall be paid to secured creditors, preferential creditors (including tax and social securities authorities) and unsecured creditors, in that order. The balance of the assets of the Company remaining after all liabilities and the costs of liquidation have been paid shall be distributed to the Shareholders in the following order of priority and in accordance with the Articles of association: (i) the amount paid up on the Special Voting Shares shall be repaid on such Special Voting Shares and (ii) any remaining assets shall be distributed to the holders of Ordinary Shares.

-

2.5 Remuneration report

This section represents the remuneration report and was prepared by the Nomination and Remuneration Committee. The remuneration report has been prepared with due observance of the requirements of Dutch law and the Code, and provides an overview of the implementation of the applicable remuneration policy for the Board of Directors in Fiscal 2024.

2.5.1 Main elements of Remuneration Policy for the Board of Directors

Pluxee’s current remuneration policy for the Board of Directors was adopted as disclosed in the Prospectus by the Company’s (pre-listing) shareholder on January 31, 2024 with immediate effect (the “Remuneration Policy”).

The Remuneration Policy’s objective is to establish a competitive remuneration and benefits framework that enables the Company to attract, retain, and motivate Directors who possess the essential leadership qualities, skills, and experience to drive exceptional business performance and promote the sustainable success of the Company.

The Remuneration Policy promotes the achievement of Pluxee’s strategic short and long-term performance objectives contributing to the achievement of Pluxee’s sustainable long-term value creation. Accordingly, the Remuneration Policy and its implementation serve Pluxee’s long-term interests and promote its sustainable success.

The Remuneration Policy establishes a fair, responsible, and transparent remuneration framework, consistent with Pluxee’s identity, mission, and corporate principles.

The Remuneration Policy establishes a remuneration framework that discourages Directors from acting in their personal interest or engaging in risk-taking that is inconsistent with Pluxee’s strategic objectives and corresponding risk appetite.

A summary of the main remuneration and benefit elements for the Executive Director and Non-Executive Directors as applicable as of January 31, 2024, is presented below for information purposes.

The remuneration and benefits awarded to Non-Executive Directors are proportional to their role and responsibilities on the Board and its Committees, as well as the time devoted to their duties and responsibilities.

Non-Executive Directors will be awarded fixed cash, consisting of (i) an annual retainer fee, (ii) an additional annual retainer fee, in respect of the Chair or Lead Director’s (as applicable) additional responsibilities assumed on the Board, and (iii) additional annual fees for their responsibilities assumed as Committee member and/or Committee chairperson.

(1) Committee chairpersons are eligible for both the Committee member fees and the additional Committee chairperson fees. Non-Executive Directors will also be eligible to receive a separate fee for each Board and Committee meeting they attend. These fees are set at a level to provide appropriate compensation for the Non-Executive Director’s time devotion, without encouraging them to organize an excessive number of Board or Committee meetings:

The Non-Executive Directors’ remuneration may be paid out in several installments. The Board determined that from Fiscal 2025 payments of the Non-Executive Directors’ remuneration would take place twice a year, in March and in September following a half of a fiscal year.

The Remuneration Policy provides for certain flexibility and usual other benefits in favor of Non-Executive Directors such as reimbursement of expenses and costs reasonably incurred in connection with the performance of their duties and responsibilities. Non-Executive Directors are not eligible for additional benefits such as retirement or pension plans or benefits related to a removal from office.

Currently, Didier Michaud-Daniel is the only Executive Director of Pluxee, and as such, he is the only Director who is subject to the remuneration framework for Executive Directors outlined in the Remuneration Policy.

In the context of the Spin-off, Didier Michaud-Daniel was appointed Executive Chair with effect from January 31, 2024. The Board of Directors on January 31, 2024 set the remuneration of the Executive Chair in accordance with the Remuneration Policy.

The Executive Chair has signed an employment contract with Bellon S.A., with an unspecified duration, under which he is currently assigned to the position of Executive Chair of Pluxee.

The remuneration of the Executive Chair falls within the limits of the Remuneration Policy applicable to Executive Directors, including severance payment under the circumstances specified in the Remuneration Policy.

• Fixed annual remuneration (base salary): 430,000 euros. • Target annual variable remuneration (cash): 25% of the fixed annual remuneration with a maximum annual variable remuneration set at 150% of the target bonus amount, i.e., 37.5% of the fixed annual remuneration. The annual variable remuneration comprises performance-based remuneration that is linked to the achievement of predetermined performance targets aligned with the Remuneration Policy objectives. The annual variable remuneration promotes the achievement of Pluxee’s strategic short-term performance objectives that contribute to Pluxee’s sustainable long-term value creation. As per the Remuneration Policy, Executive Directors may be eligible for long-term variable remuneration in the form of shares, rights to acquire shares, or share-based remuneration (LTI). Though, the current Executive Chair is not eligible for Pluxee share awards (long-term variable remuneration). The Executive Chair is eligible to receive customary fringe benefits as part of his overall remuneration and benefits package. These fringe benefits may include, but are not limited to, liability insurance, indemnification, collective health and benefit plans, retirement and pension plans, travel allowances, a company car, and other benefits that are considered appropriate taking into account benefits customary for executives in similar roles. The Executive Chair is not subject to any non-compete clause upon the end of his mandate.

In accordance with the service agreement described in the note 14.3 Related party transactions (in the Consolidated financial statements) and the Executive Chair secondment agreement, described in section 7.1.2.3 Relations with Bellon S.A., the Executive Chair’s remuneration (as well as related tax and social security costs) is re-invoiced to Pluxee up to the amount corresponding to the Executive Chair’s remuneration determined by Pluxee’s Board of Directors. This is in line with the Remuneration Policy, which provides for the possibility that the remuneration of an Executive Director is made payable via a third party. The Board of Directors shall approve the re-invoicing of this compensation on an annual basis.

-

2.6 Remuneration of the Chief Executive Officer

In the context of the Spin-off, Mr. Aurélien Sonet was appointed Chief Executive Officer as an employee of Pluxee with effect from February 1, 2024. Consequently, the Executive Chair determines the Chief Executive Officer’s remuneration. The Board is informed of the decisions taken on the Chief Executive Officer’s remuneration.

The principles for the Chief Executive Officer’s remuneration are not part of the Remuneration Policy and thus are not subject to the approval of the shareholders, and there shall be no vote in respect of the Chief Executive Officer’s remuneration, whether on the principles or the way they have been implemented, at the annual General Meeting.

2.6.1 Principles for the Chief Executive Officer’s remuneration

The total remuneration of Pluxee’s Chief Executive Officer is aligned with short-term and long-term key objectives reflecting Pluxee’s strategy.

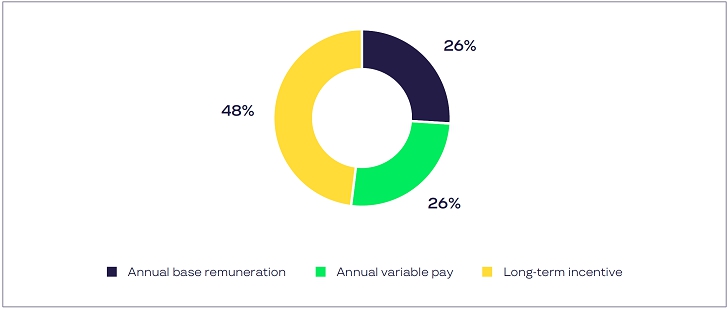

• annual base remuneration; • annual variable pay with a 100% target compared to annual base pay and a maximum of 150% to reward outperformance; • long-term incentive: award pursuant to a three-year performance-based share plan subject to continuous presence within the Group. • finally, Pluxee’s CEO benefits from a defined benefit pension plan. The Chief Executive Officer is eligible for Pluxee’s long-term incentive awards pursuant to a Group policy aiming to offer competitive awards in view of the market environment. Both short-term and long-term incentives include demanding performance conditions, including ESG conditions, to reflect Pluxee’s strategy.

In Fiscal 2025, short-term incentives to be included in the Chief Executive Officer’s variable remuneration will encompass a free cash flow-related indicator.

-

2.7 Performance shares

2.7.1 Grants of performance shares

Further to the grants under several performance share-based plans in February 2024 the outstanding 1,139,412 rights to performance shares represented 0.8% of Pluxee N.V.’s ordinary share capital as of August 31, 2024.

Pluxee has a clear performance-based compensation philosophy and grants performance shares to approximately 200 employees each year. The eligibility is based on managerial decisions to retain and reward senior leaders and key talent. For Fiscal 2024 onward, the performance conditions are shared by all beneficiaries including quantitative financial and non-financial objectives in line with the Group strategy.

The Fiscal 2024 plan performance period will end on August 31, 2026, with delivery date of March 1, 2027.

Weight Financial performance conditions Organic Revenue Growth rate(1) 40% Recurring Operating Profit Margin rate(2) 30% Non-financial quantitative performance conditions 30% 1. Diversity: achieve target of women within Pluxee Leadership(3) at the end of Fiscal 2026 (15%) 2. Trusted partner: improve NPS client score over the 3 years (15%) (1) See definition in section 3.5 Alternative performance measure (APM) definitions. (2) Pluxee’s Recurring Operating Profit Margin rate corresponds to Recurring Operating Profit divided by Total Revenues, excluding currency effects. (3) Pluxee Leadership includes the Chief Executive Officer, Pluxee’s Executive Committee, the direct reports of the Pluxee Executive Committee members (excluding executive assistants) and the members of Local Leadership. Transitional plans were put in place to maintain past Sodexo long-term incentives for Pluxee employees – including the CEO – who left Sodexo on February 1, 2024 and no longer meet the Sodexo presence condition required by the plan up to the end of the vesting period.

Fiscal 2023 plan: performance period will end on August 31, 2025, with a delivery date March 2, 2026

Weight(1) Financial performance conditions Organic Revenue Growth rate 40% Recurring Operating Profit margin rate 20% Relative performance on Recurring Operating Profit Margin: reach target above competition 20% Non-financial quantitative performance conditions 1. Diversity (10%) 20% 2. Sustainability (10%) (1) Criteria and weighting applicable to Pluxee’s Executive Committee only, including the Chief Executive Officer. Fiscal 2022 plan: performance period will end on August 31, 2024, with delivery date March 3, 2025 (and a subsequent holding period of one year up to March 3, 2026, applicable to beneficiaries working in France only).

(1) Criteria and weighting applicable to the Chief Executive Officer only. (2) Revenue includes the interest income, that is generated on cash not related to the float (classified in financial income in Pluxee’s consolidated financial statements). (3) The Underlying Operating Profit is a financial indicator used by Sodexo. The Underlying Operating Profit, as defined by Sodexo, corresponds to Recurring operating profit (as defined by Pluxee) adjusted (i) to exclude management fees and amortization of intangible assets acquired through business combination and (ii) to include interest income generated on cash not related to the float. Underlying Operating Profit Margin rate corresponds to such Underlying Operating Profit divided by Total Revenues (adjusted to include interest income generated on cash not related to the float, currently classified in Financial income in Pluxee Consolidated Financial Statements). (4) Achievement not available at time of publication of this Annual Report. See definition of TSR in section 8.5.2. -

2.8 Corporate governance statement

2.8.1 Disclosures pursuant the Dutch Decree on article 10 of the Takeover Directive

In accordance with the Dutch Decree on article 10 of the Takeover Directive (Besluit artikel 10 overnamerichtlijn) (the “Takeover Decree”), the Company makes the following disclosures:

a. For information on the capital structure of the Company, the composition of the issued share capital and the existence of the classes of shares, see section 7.1.2 and note 8 to the Company financial statements. For information on the rights attached to the Ordinary Shares and the Special Voting Shares, see section 2.4.1 and the Articles of Association and the Loyalty Voting Plan which can both be found on the Company’s website. At August 31, 2024, the issued share capital of the Company consisted of 147,174,692 ordinary shares, representing 70.01% of the aggregate issued share capital amounting to 2,102,150.55 euros, and 63,040,363 Special Voting Shares, representing 29.99% of the aggregate issued share capital. b. The Articles of Association do not provide for transfer restrictions for Ordinary Shares but do provide for transfer restrictions for Special Voting Shares (see article 15 of the Articles of Association). The Loyalty Voting Plan provides for transfer restrictions for Ordinary Shares included in the Loyalty Share Register and to Special Voting Shares (see articles 9 and 10 of the Loyalty Voting Plan). c. For information on shares in the Company’s capital in respect of which pursuant to sections 5:34, 5:35 and 5:43 of the Dutch financial supervision act (Wet op het financieel toezicht) notification requirements apply, see section 7.1.3.4, which contains an overview of shareholders who declared holdings of 3% or more at the stated date. d. No special control rights accrue to shares in the capital of the Company. e. The Company has not yet launched any employee share participation program in the sense of article 1 sub 1(e) of the Takeover Decree. Pluxee’s employee shares partially result from the past Sodexo employee stock ownership plans. They are held indirectly through a Pluxee mutual fund (fonds commun de placement d’entreprise, “FCPE”) or held in direct shareholding. The FCPE’s unit-holders are current and former employees of Sodexo and Pluxee: three out of six members of the supervisory board of this mutual fund are elected members selected among the unit-holders employed by Pluxee. The supervisory board exercises the voting rights attached to the Ordinary Shares held within the fund based on the choices of these elected members. f. No restrictions apply to voting rights attached to shares in the capital of the Company (see section 2.4). There are not any deadlines for exercising voting rights other than the final registration date for the general meetings of the Company. The Articles of Association allow the Company to cooperate in the issuance of depository receipts for shares in its capital. At August 31, 2024, no depository receipts have been issued for shares in the capital of the Company. g. The Company is not aware of the existence of any agreements with Shareholders which may result in restrictions on the transfer of shares or limitation of voting rights. h. The procedures regarding the appointment and dismissal of Directors are stated in article 17 of the Articles of Association. The procedure for the amendment of the Articles of Association is stated in article 27 of the Articles of Association. For further information on the rules governing the appointment and dismissal of Directors, see sections 2.1.1.4 and 2.1.1.5. For further information on rules regarding amendments of the Articles of Association, see section 2.4.2.4. i. The general meeting of the Company resolved on January 31, 2024 to authorize the Board of Directors to issue Ordinary Shares and to grant rights to subscribe for such Ordinary Shares as well as to restrict or exclude pre-emptive rights accruing to Shareholders in connection with issuances or granting of rights under the aforementioned authorization (for more information see section 7.1.2.1). In addition, the Company has the authority to acquire shares in its own share capital and to cancel such shares (for more information see sections 7.1.3.2 and 7.1.3.3). j. The Company is not a party to any significant agreements which will take effect, be altered or terminated upon a change of control of the Company as a result of a public offer within the meaning of Section 5:70 of the Dutch financial supervision act, provided that some of the loan and guarantee agreements entered into, and some notes issued, by Pluxee contain clauses that, as it is customary for such financial transactions, may require early repayment or termination in the event of a change of control of the guarantor or the borrower. In certain cases, that requirement may only be triggered if the change of control event coincides with other conditions, such as a rating downgrade. k. The Company is not party to any contract with a director or an employee, which provides for a payment on termination of employment in connection with a public offer within the meaning of Article 5:70 of the Dutch financial supervision act. -

3.1 Fiscal 2024 Highlights

3.1.1 Executive Summary

• All business targets achieved - Strong commercial development fueled by continuous investment in Pluxee’s full range of innovative solutions, powerful commercial engine and best-in-class tech capabilities • 1,210 million euros Total Revenues, representing +18.6% Organic revenue growth, well above low double-digit target • 430 million euros Recurring EBITDA, growing +24.8% organically, with a Recurring EBITDA margin at 35.6% reported, i.e. 36.4% on an organic basis implying a +183bps increase, compared to initial objective of stable margin • 379 million euros Recurring free cash flow, i.e. 88% cash conversion rate significantly above 70% target and increased Net financial cash position of 1,054 million euros • Enhanced shareholder distribution policy with 0.35 euro proposed dividend per share, corresponding to a 25% payout based on an expanded basis of Adjusted net profit1 at 203 million euros • Fiscal 2025 and 2026 financial objectives revised upward reflecting the Group’s confidence in structural market growth trends, its proven business model and ability to deliver successfully on its strategic plan: ○ low double-digit Organic revenue growth each year confirmed on a higher Fiscal 2024 base; ○ +75bps Recurring EBITDA margin expansion expected in each of Fiscal 2025 and 20262, leading to delivery of the initial 3-year target of +250bps organic increase one year ahead of plan ○ above 75% Recurring cash conversion rate on average over Fiscal 2024-2026 vs. above 70% previously (in million euros) Fiscal 2024 Fiscal 2023 Organic growth Total Growth Total Revenues 1,210 1,052 18.6% 15.0% Recurring EBITDA 430 363 24.8% 18.5% Recurring EBITDA margin 35.6% 34.5% +183bps +105bps Net profit for the year(3) 133 81 64.2% Recurring free cash flow 379 289(4) 31.1% Recurring cash conversion (%) 88% 80%(4) Net Financial (Debt) / Cash 1,054 859 “As we conclude our first fiscal year, I am proud to announce that we have exceeded all our business and financial objectives. Fiscal 2024 was marked by the significant transformation of the Group as a standalone and listed company and by the delivery of outstanding Organic revenue growth, strong Recurring EBITDA margin expansion and robust cash conversion. Demonstrating our commitment to a clear capital allocation framework, we have made significant strides on our M&A roadmap with the deployment of our partnership with Santander in Brazil and the successful acquisition of Cobee in Spain while pursuing our investments in growth and enhancing our shareholder distribution policy.

These achievements reflect the remarkable efforts and unwavering commitment of all our employees and I would like to thank them for their contribution to this success. As we transition to Fiscal 2025, I am confident that Pluxee is well-positioned to deliver on its objectives going forward, continuing to generate sustainable low double-digit organic growth combined with steady margin expansion and strong cash flow generation. This is underpinned by the disciplined execution of our strategic roadmap, driven by product innovation, a powerful commercial engine, best-in-class tech capabilities and a targeted M&A strategy, creating value for all our shareholders, clients, consumers and merchant partners.”

Aurélien Sonet, Chief Executive Officer of Pluxee

-

3.2 Fiscal 2024 Performance

3.2.1 Consolidated Financial results

(in million euros) Fiscal 2024 Fiscal 2023 Total Growth Total Revenues 1,210 1,052 15.0% Operating expenses (780) (689) 13.2% Recurring EBITDA(1) 430 363 18.5% Depreciation, amortization and impairment (89) (78) 13.7% Recurring operating profit (Recurring EBIT) 341 285 19.8% Other operating income and expenses (92) (150) -38.9% Operating profit (EBIT) 250 135 85.1% Financial income and expenses (20) 28 -170.4% Profit before tax for the year 230 163 41.1% Income tax expense (91) (80) 13.7% Share of net profit of companies accounted for using the equity method (0) — — Net profit for the year 139 83 67.3% Of which: — Attributable to the equity holders of the parent 133 81 64.2% Attributable to non-controlling interests 6 2 177.5% (1) Supplemental non-IFRS financial measure defined in section 3.5 Alternative performance measure (APM) definitions. Total Revenues stood at 1,210 million euros in Fiscal 2024, representing an Organic growth rate of +18.6%, well above the Group’s financial objectives communicated during the Capital Markets Day on January 10, 2024 (i.e. low double digit Organic revenue growth). Currency fluctuations led to a -3.9% impact, mainly due to operations in Türkiye and Brazil, while recording a +0.4% scope effect related to the integration of Santander Brazil’s Employee Benefit activity following the closing of the strategic partnership in June 2024. This strong performance highlights the positive business momentum experienced by the Group and its commitment to disciplined execution.

Over Fiscal 2024, Operating revenue grew +13.3% organically (+10.7% Total Growth) to 1,055 million euros while Float revenue was up +69.0% organically (+56.4% Total Growth) to 155 million euros.

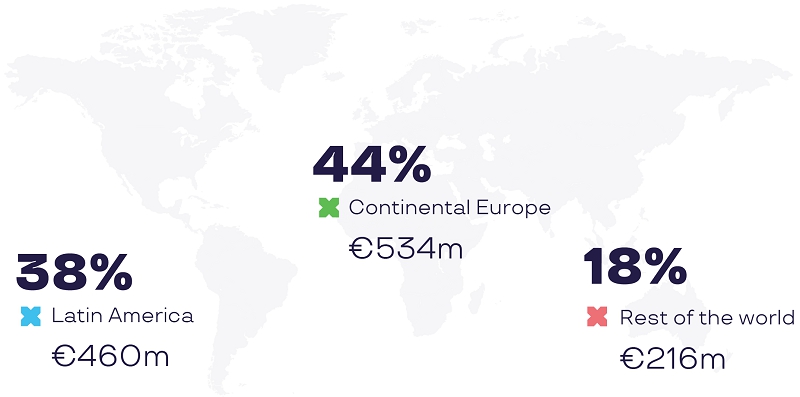

Total Revenues in Continental Europe grew +14.4%, i.e. +14.5% organically, up +68 million euros, to 534 million euros, accounting for 44% of Total Revenues.

Total Revenues in Latin America grew +16.8%, i.e. +17.3% organically, up +66 million euros, to 460 million euros, accounting for 38% of Total Revenues.

Total Revenues in Rest of the world grew +31.0% organically, excluding a -18.2% currency impact, up +24 million euros to 216 million euros, accounting for 18% of Total Revenues.

Operating revenue for Fiscal 2024 increased to 1,055 million euros, up +10.7% compared to Fiscal 2023, including a -2.9% currency effect and a +0.3% positive scope effect related to the integration of Santander Brazil’s Employee Benefit activity since the closing date of the strategic partnership. With +13.3% organic growth delivered over the year, Pluxee continued to present a sustained pace of growth in Operating revenue, driven by the Employee Benefit line of services over Fiscal 2024.

Employee Benefits generated 892 million euros in Operating revenue over Fiscal 2024, growing +16.7% organically, excluding -3.5% negative currency effect. Operating revenue in the Employee Benefits business accounted for 85% of total Operating revenue.

Performance in Employee Benefits was fueled by double-digit growth in business volume issued, supported by a steady increase in the average take-up rate for Fiscal 2024 which grew to 4.95% compared to 4.73% in Fiscal 2023. Such improvement in the take-up rate reflects the Group’s strong commercial focus as well as the positive impact of the change in regulation in Brazil on client commission rates. Substantial growth in business volume resulted from the strong commercial dynamics experienced by the Group across countries and client sizes, leveraging its powerful commercial engine to win both large accounts and small and medium enterprises. Growth was further driven by the continuous efforts deployed to realize the full potential of the client portfolio through further increases in average face value and cross-selling.

Other Products and Services generated Operating revenue of 163 million euros in Fiscal 2024 compared to 167 million euros in Fiscal 2023 representing 15% of total Operating revenue. The performance of Other Products and Services reflected changes in some Public Benefit contracts, including the discontinuation of a Public Benefit contract in Chile (Latin America) and large programs issued in Fiscal 2023 in Continental Europe. The Group continued to rationalize its portfolio in the UK and U.S. in order to focus on the digital Employee Engagement offering. Except in Chile, all significant Public Benefit contracts have been successfully renewed paving the way for a progressive return to growth in that line of service over Fiscal 2025.

The ongoing robust performance in Operating revenue reflected positive business dynamics across countries with all regions delivering double digit organic growth over the fiscal year.

In Continental Europe, Operating revenue grew +11.4%, up +49 million euros to 472 million euros and +11.5% organically. This solid performance is driven by strong commercial momentum in Western European countries such as Belgium and France while facing high comparison bases in Central and Eastern Europe, especially over the second half of Fiscal 2024.

Growth was driven by strong commercial momentum with Pluxee solutions experiencing growing traction, particularly in Belgium and France. As an example, Pluxee was entrusted by the French security forces with meal benefit distribution for the Paris 2024 Olympics. As such, more than 90,000 civil servants and military personnel were equipped with a meal card for the entirety of the games. Positive momentum was also fueled by the continuous increase in average face value to reach the legal face value cap established by Public Authorities, as is the case in Romania. Cross-selling across Pluxee’s product range also contributed significantly to the steady performance delivered over the year in the region. In Belgium, the Group was able to leverage a one-off government measure supporting purchasing power to develop and deploy a non-recurring benefit program to existing and new clients.

In Latin America, Operating revenue reached 405 million euros in Fiscal 2024, growing +13.2% organically, excluding a -5.5% currency impact attributable to Brazil and Mexico, particularly during the fourth quarter.

The solid performance in Latin America resulted from strong new development, driven by the growing penetration of small and medium enterprises. In Brazil and Mexico, small and medium enterprises represented around 35% of business volume growth over the year. Pluxee continued to manage actively its client portfolio, constantly leveraging analytics to advise clients in driving average face value upward.

The performance of the region in the second half of Fiscal 2024 reflected the change in regulation that occurred in Brazil in May 2023, and the discontinuation of a Public benefit contract in Chile. As a result, Operating revenue organic growth in Latin America landed at +6.5% in the second half of Fiscal 2024 and is expected to rebound in the First Half Fiscal 2025.

In Rest of the world, Operating revenue amounted to 178 million euros in Fiscal 2024, showing +18.0% Organic growth excluding a -12.8% currency impact mostly related to the evolution of the Turkish Lira.

Performance was driven in the region by the growing adoption and usage of Pluxee solutions across countries. In Türkiye, the Group has continued to take advantage of the hyperinflationary environment ensuring additional increases in average face value across its client portfolio and further penetrating the meal benefit segment by signing new contracts. Development was also particularly strong in India across the full range of employee benefit products.